In today’s entrepreneurial age, the importance of intellectual property (IP) protection cannot be overstated. The increase in new businesses being incorporated and the growth of existing ones creates a complex landscape where clashes over trademarks, copyrights, and patents are becoming more common and the recent case involving the luxury good giant LVMH highlights the challenges smaller companies face when larger entities oppose their IP applications.

This case, the details of which can be found here, is your typical David v Goliath battle. A Norfolk couple applied to register the trade mark LV Bespoke to protect its home and gardening business. LVMH, perhaps unsurprisingly given the value of the brand, objected to the registration arguing that it was too similar to their mark and an attempt to ride on the coat tails of Louis Vuitton’s reputation. Usually at this stage the minnow would back down in the face of such opposition but L V Bespoke stood their ground and after 2 years and £15,000 in costs they won and succeeded in getting their mark registered.

This case matters because often smaller companies cave in to those with deeper pockets and expensive lawyers and it doesn’t come without cost. If a company is forced to change its name or pull a product from the market following an IP dispute, the costs can be devastating.

So, to avoid IP disputes please consider the following points when creating and exploiting your IP:

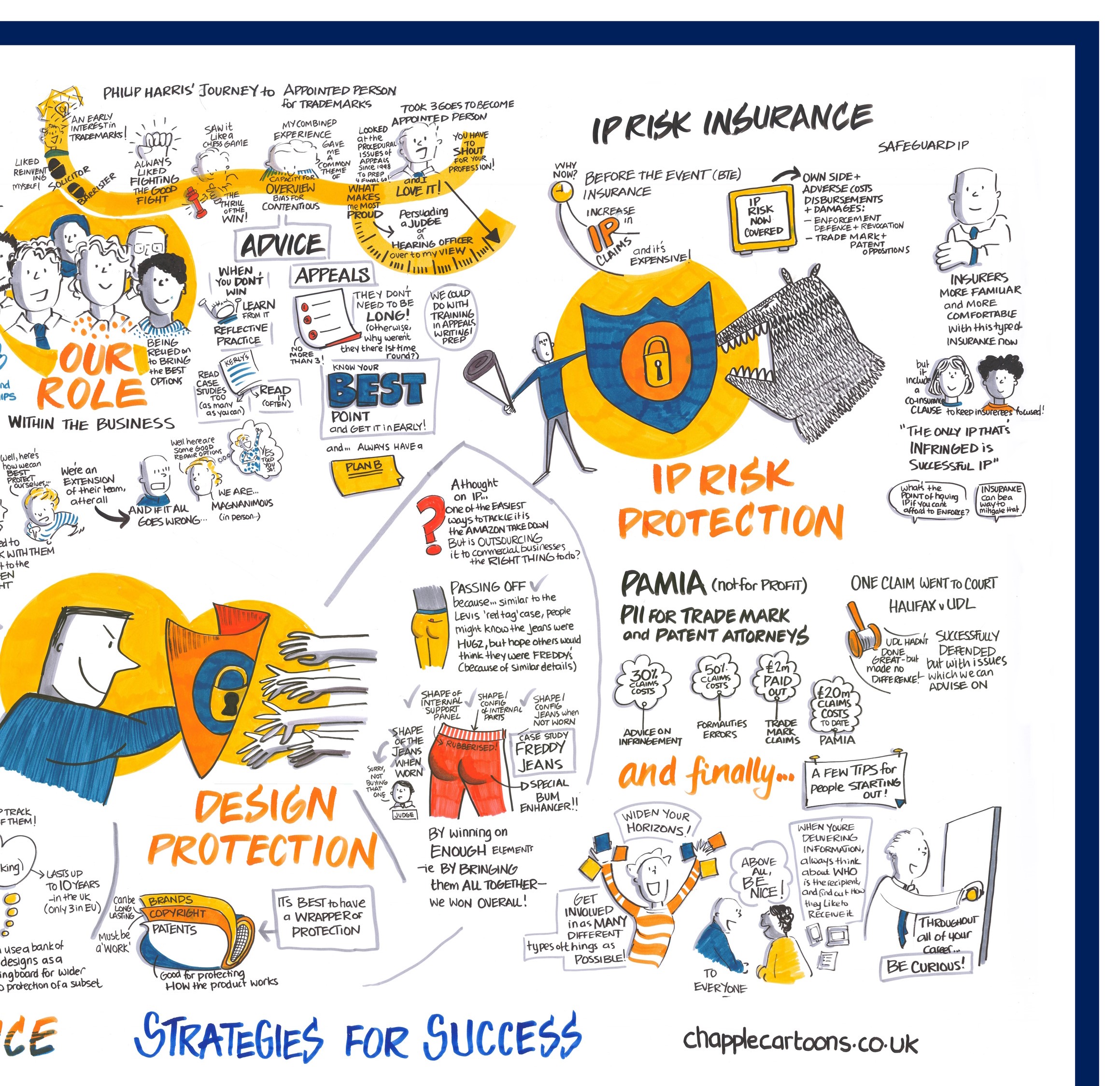

Legal Guidance: It’s crucial to seek early legal advice from a qualified intellectual property attorney. They can guide you through the process, help you navigate potential objections, and provide valuable insights for a successful IP strategy.

Proactive Protection: Don’t wait until a dispute arises to think about IP protection. Registering trademarks and patents early in the business development process can be a proactive measure to prevent future conflicts.

Documentation: Keep detailed records of your IP creation and use, including dates, prototypes, design processes, etc. This documentation can serve as evidence in case of a dispute and strengthen your position.

IP Strategy: Develop a comprehensive IP strategy that aligns with your business goals. This may include licensing agreements, monitoring competitors’ activities, and actively enforcing your IP rights when necessary.

Regular Audits: Periodically review and reassess your IP strategy. This is especially important as your business evolves, launches new products, or enters different markets.

Take out IP insurance: This will level the playing field by funding any oppositions/litigation that arises. It will enable you to enforce your IP as your business grows

IP is a hugely important tool for adding value to a business but, unfortunately, the system is not perfect. The process of acquiring rights can be lengthy, complicated and expensive and often those with the deepest pockets are able to game the system most effectively. However, by seeking sound professional advice as early as possible and putting IP insurance in place, you too can use IP to protect what you have worked so hard to create

For more information on how to obtain a quote for IP insurance, get in touch today or complete the form here